Provides Business Updates and Long-Term Financial Objectives

Expects to Deliver Strong Earnings Per Share Growth, $1.35 Billion Capital Return to Shareholders through 2021

NEW YORK, March 14, 2019 — Assurant, Inc. (NYSE: AIZ), a global provider of risk management solutions, today will offer an update on the company’s go-forward strategy to deliver sustained outperformance and drive shareholder value at its 2019 Investor Day in New York City.

Driving Outperformance

Assurant President and CEO Alan B. Colberg and other company senior executives will highlight progress made since 2015 in repositioning the company for more diversified double-digit earnings growth, continued strong cash flow generation and disciplined capital deployment across its Global Housing and Global Lifestyle segments.

The company will present its approach to innovation to further evolve its offerings and capabilities, beyond traditional insurance, to meet customer needs. Presentations will focus on the company’s key growth businesses including: Connected Living, Global Automotive and Multifamily Housing.

“We have a strong track record of outperformance for our clients, our end-consumers, our communities and our employees, which has enabled us to deliver superior shareholder returns since our 2004 IPO,” said Colberg. “Through our transformation and ongoing investments to support innovation, we are well positioned to deliver outperformance, both now and in the future.”

Enterprise Financial Objectives

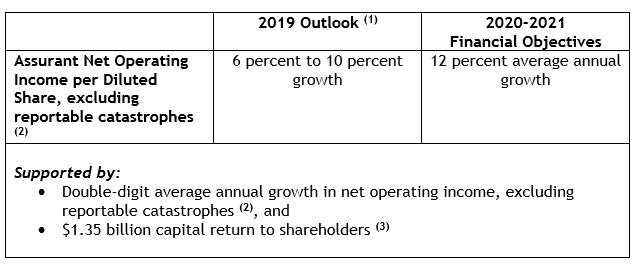

During the event, Assurant executives will discuss the company’s long-term enterprise and segment financial objectives to increase shareholder value, including expectations to:

The company expects to return a total of approximately $1.35 billion to shareholders through the end of 2021, through common stock dividends and share repurchases, while also continuing to invest in business growth and maintain its Investment Grade debt ratings. Repurchases and common stock dividends are subject to approval by the Board and other factors, including those described below.

“We’re confident in our ability to continue to drive profitable growth and strong returns across our portfolio. With more diversified earnings and reduced catastrophe exposure, we expect to continue to generate significant cash flow, which we intend to reinvest in our business to support long-term growth and innovation and return excess capital to shareholders over time,” Colberg continued.

In the fifteen years since going public, Assurant has raised its common stock dividend every year and repurchased 62 percent of its common stock.

(1) 2019 Outlook provided on Feb. 12, 2019

(2) Reportable catastrophe losses include individual Insurance Services Office (“ISO”) events, greater than $5 million pre-tax, net reinsurance and include reinstatement premiums.

(3) Includes share repurchases and common stock dividends, subject to Board approval and other factors, including those described under the safe harbor statement.

Investor Day Webcast

A live webcast of the event will be held on March 14, 2019 at 9 a.m. ET. The live and archived replay of the presentations will be available through the Investor Relations section of Assurant's website at www.assurant.com. Slides of the presentations will be posted for viewing shortly before the event begins.

Safe Harbor Statement

Some of the statements included in this news release, particularly those anticipating future financial performance, business prospects, growth and operating strategies and similar matters, including our ability to grow net operating income, excluding reportable catastrophes (including on a per diluted share basis), and our ability to return capital to shareholders, through share repurchases, common stock dividends or otherwise, and our capital deployment strategy, are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these statements by the use of words such as “outlook,” “objectives,” “will,” “may,” “can,” “anticipates,” “expects,” “estimates,” “projects,” “intends,” “plans,” “believes,” “targets,” “forecasts,” “potential,” “approximately,” or the negative version of those words and other words and terms with a similar meaning. Any forward-looking statements contained in this news release are based upon our historical performance and on current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. Our actual results might differ materially from those projected in the forward-looking statements. The company undertakes no obligation to update or review any forward-looking statements in this news release, whether as a result of new information, future events or other developments. The following risk factors could cause our actual results to differ materially from those currently estimated by management, including those projected in the financial objectives:

| (i) | the loss of significant clients, distributors and other parties or those parties facing financial, reputation and regulatory issues; |

| (ii) | significant competitive pressures, changes in customer preferences and disruption; |

| (iii) | the failure to find and integrate acquisitions, including The Warranty Group, or grow organically and risks associated with joint ventures; |

| (iv) | the impact of general economic, financial market and political conditions, including unfavorable conditions in the capital and credit markets, and conditions in the markets in which we operate; |

| (v) | risks related to our international operations and fluctuations in exchange rates; |

| (vi) | the impact of catastrophic and non-catastrophe losses; |

| (vii) | our inability to recover should we experience a business continuity event; |

| (viii) | our inability to develop and maintain distribution sources or attract and retain sales representatives; |

| (ix) | failure to manage vendors and other third parties who conduct business and provide services to our clients; |

| (x) | declines in the value of mobile devices and export compliance risk in our mobile business; |

| (xi) | negative publicity relating to our products and services or the markets in which we operate; |

| (xii) | failure to implement our strategy, including achieving efficiencies and cost savings, and to attract and retain key personnel, including senior management; |

| (xiii) | employee misconduct; |

| (xiv) | the adequacy of reserves established for claims and our inability to accurately predict and price for claims; |

| (xv) | a decline in financial strength ratings or corporate senior debt ratings; |

| (xvi) | an impairment of goodwill or other intangible assets; |

| (xvii) | failure to maintain effective internal control over financial reporting; |

| (xviii) | a decrease in the value of our investment portfolio including due to market, credit and liquidity risks; |

| (xix) | the impact of U.S. tax reform legislation and impairment of deferred tax assets; |

| (xx) | the unavailability or inadequacy of reinsurance coverage and credit risk of reinsurers, including those to whom we have sold business through reinsurance; |

| (xxi) | the credit risk of some of our agents; |

| (xxii) | the inability of our subsidiaries to pay sufficient dividends to the holding company and limitations on our ability to declare and pay dividends and repurchase shares; |

| (xxiii) | changes in the method for determining or replacement of LIBOR; |

| (xxiv) | failure to effectively maintain and modernize our information technology systems and infrastructure and integrate those of acquired businesses; |

| (xxv) | breaches of our information systems or those of third parties or failure to protect data in such systems, including due to cyber-attacks; |

| (xxvi) | costs of complying with, or failure to comply with, extensive laws and regulations to which we are subject, including related to privacy, data security and data protection; |

| (xxvii) | the impact from litigation and regulatory actions; |

| (xxviii) | reductions in the insurance premiums we charge; and |

| (xxix) | changes in insurance and other regulation. |

For a detailed discussion of the risk factors that could affect our actual results, please refer to the risk factors identified in our SEC reports, including, but not limited to our Annual Report on Form 10-K, as filed with the SEC.

About Assurant

Assurant, Inc. (NYSE: AIZ) is a global provider of risk management solutions, protecting where consumers live and the goods they buy. A Fortune 500 company, Assurant focuses on the housing and lifestyle markets, and is among the market leaders in mobile device protection and related services; extended service contracts; vehicle protection products; pre-funded funeral insurance; renters insurance; and lender-placed homeowners insurance. Assurant has a market presence in 21 countries, while its Assurant Foundation works to support and improve communities. Learn more at assurant.com or on Twitter @AssurantNews.

Media Contact:

Linda Recupero

Senior Vice President, Enterprise Communication

212.859.7005

[email protected]

Investor Relations Contacts:

Suzanne Shepherd

Senior Vice President, Investor Relations

212.859.7062

[email protected]

Sean Moshier

Director, Investor Relations

212.859.5831

[email protected]