4Q 2017 Net Income of $312.9 million, $5.76 per diluted share Full-Year 2017 Net Income of $519.6 million, $9.39 per diluted share

4Q 2017 Net Operating Income of $99.9 million, $1.84 per diluted share Full-Year 2017 Net Operating Income of $220.0 million, $3.98 per diluted share

NEW YORK, Feb. 8, 2018 — Assurant, Inc. (NYSE: AIZ), a global provider of risk management solutions, today reported results for the fourth quarter and full-year ended Dec. 31, 2017.

|

• Key Financial Highlights Full-Year 2017

|

* Reportable catastrophes of $192.5 million after-tax include catastrophe losses, net of reinsurance and client profit sharing adjustments, as well as reinstatement and other premiums.

"In 2017, we surpassed our initial expectations for the year and delivered strong growth in net operating income and earnings per share, on a year-over-year basis, excluding catastrophes losses. Consistent with our capital management commitment, we also completed the return of $1.5 billion of capital to shareholders since 2016," said Assurant President and Chief Executive Officer Alan Colberg.

"We expect to build on this solid foundation in 2018, as we close our acquisition of The Warranty Group and leverage our expanded scale and expertise in key Housing and Lifestyle markets to sustain long-term, profitable growth at Assurant," Colberg added.

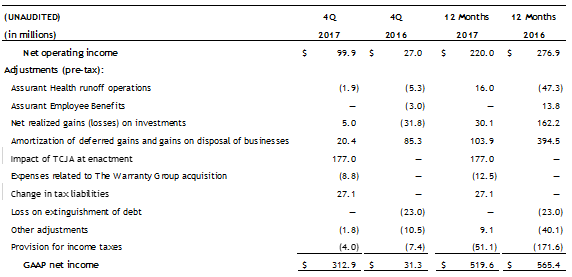

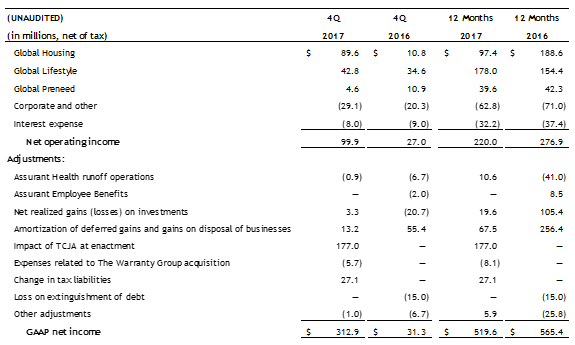

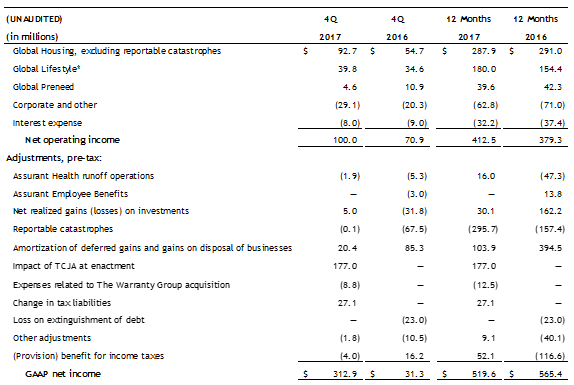

Reconciliation of Net Operating Income to GAAP Net Income

Additional financial information, including a schedule of disclosed items that affected Assurant’s results by business for the last eight quarters, appears on page 21 of the company’s Financial Supplement and is located on Assurant’s Investor Relations website http://ir.assurant.com/investor/default.aspx.

Fourth Quarter 2017 Consolidated Results

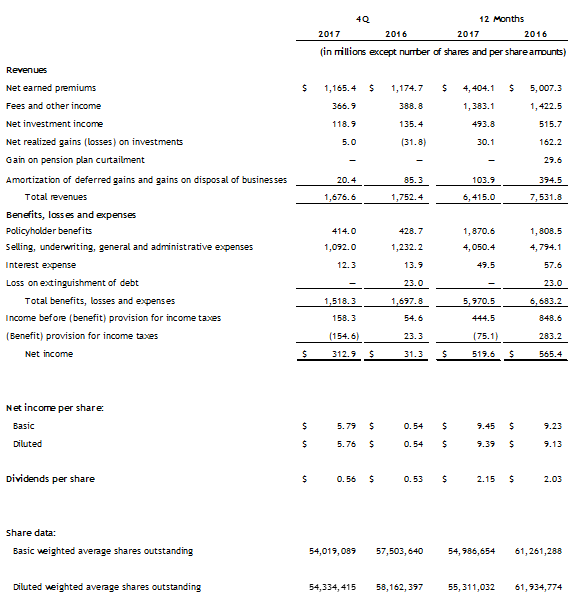

- Net income was $312.9 million, or $5.76 per diluted share, compared to fourth quarter 2016 net income of $31.3 million, or $0.54 per diluted share. The increase was primarily due to a one-time benefit of $177 million from the reduction of net deferred tax liabilities related to the enactment of the U.S. Tax Cuts and Jobs Act, as well as higher contributions from Global Housing, which benefitted from lower reportable catastrophes and the absence of lender-placed regulatory expenses.

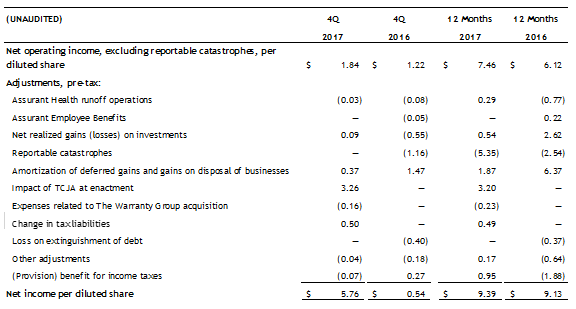

- Net operating income4 increased to $99.9 million, or $1.84 per diluted share, compared to fourth quarter 2016 net operating income of $27.0 million, or $0.46 per diluted share. This was driven primarily by lower reportable catastrophes and the absence of lender-placed regulatory expenses in Global Housing, compared to fourth quarter 2016. Excluding reportable catastrophes, net operating income for fourth quarter 2017 increased to $100.0 million, or $1.84 per diluted share, compared to $70.9 million, or $1.22 per diluted share, in the prior year period. This was largely due to the absence of Global Housing lender-placed regulatory expenses and higher contributions from Global Lifestyle, primarily from global mobile programs within Connected Living, including a $5 million client recoverable.

- Net earned premiums, fees and other income from the Global Housing, Global Lifestyle and Global Preneed segments totaled $1.52 billion, compared to $1.54 billion in fourth quarter 2016, reflecting a previously disclosed change in a program structure for a large service contract client in Global Lifestyle. Absent this change, revenue increased 5 percent, driven by continued growth in mobile, vehicle protection services and multifamily housing, offset by declines in mortgage solutions and lender-placed insurance.

Full-Year 2017 Consolidated Results

- Net income decreased to $519.6 million, or $9.39 per diluted share, compared to full-year 2016 net income of $565.4 million, or $9.13 per diluted share. The decrease was mainly due to lower amortization of deferred gains and gains on disposal of Assurant Employee Benefits and higher reportable catastrophes related to Hurricanes Harvey, Irma and Maria. This decrease was partially offset by the one-time reduction of net deferred tax liabilities following the enactment of the U.S. Tax Cuts and Jobs Act.

- Net operating income4 decreased to $220.0 million, or $3.98 per diluted share, compared to full-year 2016 net operating income of $276.9 million, or $4.47 per diluted share, primarily due to higher reportable catastrophes and the ongoing lender-placed normalization. The absence of lender-placed regulatory expenses in Global Housing, higher contributions from Global Lifestyle, and lower corporate expenses partially offset the decline. Excluding reportable catastrophes, net operating income for full-year 2017 increased to $412.5 million, or $7.46 per diluted share, compared to $379.3 million, or $6.12 per diluted share in 2016. The absence of lender-placed regulatory expenses in Global Housing, higher contributions from Global Lifestyle, and lower corporate expenses were the main drivers.

- Net earned premiums, fees and other income from the Global Housing, Global Lifestyle and Global Preneed segments totaled $5.8 billion, compared to $6.2 billion in 2016, driven by a previously disclosed change in a program structure for a large service contract client in Global Lifestyle. Absent this change, total revenue was up 2 percent due to growth in Connected Living, vehicle protection and multifamily housing businesses, partially offset by declines in lender-placed and mortgage solutions.

Reportable Segments

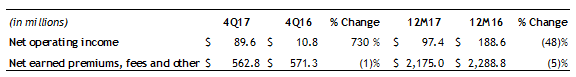

- Net operating income increased in the fourth quarter mainly due to lower reportable catastrophes and the absence of lender-placed regulatory expenses compared to the prior year period. Results also included increased income for processing National Flood Insurance Program (NFIP) flood claims following Hurricane Harvey, and more favorable non-catastrophe loss experience. In the fourth quarter 2017, Global Housing recorded $3.1 million in net reportable catastrophes, reflecting losses mainly from California wildfires, partially offset by reductions in net losses and reinstatement premiums related to third quarter 2017 reportable catastrophes. Fourth quarter 2016 included $43.9 million in reportable catastrophe losses. Full-year 2017 net operating income declined year-over-year primarily due to higher reportable catastrophe losses. Excluding these losses, full-year 2017 net operating income was down slightly from 2016 levels due to higher non-catastrophe losses, including elevated claims from weather events that did not reach Assurant’s reportable catastrophe threshold, and the ongoing normalization of lender-placed insurance. These were partially offset by the absence of lender-placed regulatory expenses, higher income for processing NFIP flood claims following Hurricane Harvey, and profitable growth in multifamily housing.

- Net earned premiums, fees and other income decreased in fourth quarter 2017, mainly reflecting lower lender-placed insurance revenue, net of reduced catastrophe premiums, as well as lower volumes from originations and field services in mortgage solutions. This was partially offset by growth in multifamily housing and revenue from new lender-placed loans onboarded in 2017. For full-year 2017, net earned premiums, fees and other income decreased, compared to 2016, driven by lower placement rates in lender-placed insurance and declines in mortgage solutions. The decline was partially offset by growth in multifamily housing and revenue from new lender-placed loans onboarded earlier in 2017.

- Combined ratio for risk-based businesses(a) decreased to 75.2 percent from 105.0 percent in fourth quarter 2016. This reflects lower reportable catastrophes compared to the fourth quarter 2016. Excluding these losses, the combined ratio improved to 74.1 percent from 88.8 percent in the prior year period, primarily due to lower expenses, including the absence of lender-placed regulatory expenses, increased NFIP income, and more favorable non-catastrophe loss experience. For full-year 2017, the combined ratio for risk-based businesses increased to 99.1 percent from 91.1 percent in 2016, driven by higher reportable catastrophes. Excluding these losses, the combined ratio improved to 81.0 percent from 81.7 percent in 2016, primarily due to the lower lender-placed regulatory expenses.

- Pre-tax margin for fee-based, capital-light businesses(b) decreased to 10.6 percent, from 11.2 percent in the fourth quarter of 2016. Declines in mortgage solutions, mainly from lower client volumes and weaker market demand for valuation and field services, were partially offset by growth in multifamily housing. For full-year 2017, the pre-tax margin for fee-based, capital-light businesses was 10.1 percent, compared to 10.8 percent in 2016. The decrease was primarily due to greater reportable catastrophes in 2017. Excluding the impact of reportable catastrophes, the pre-tax margin for the full-year 2017 was relatively flat as growth in multifamily housing was offset by declines in mortgage solutions.

(a) Combined ratio for the Global Housing risk-based businesses is equal to total policyholder benefits, losses and expenses, divided by net earned premiums and fees and other income, for lender-placed and manufactured housing and other businesses. Income from processing NFIP claims is reported as a reduction in expenses and is included in the combined ratio.

(b) Pre-tax margin for the Global Housing fee-based, capital-light businesses is equal to income before provision for income taxes divided by total net earned premiums, fees and other income, for multifamily housing and mortgage solutions businesses.

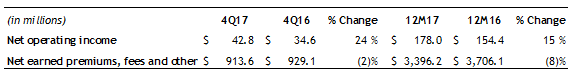

- Net operating income increased in fourth quarter 2017, primarily due to higher contributions from Connected Living, driven by global mobile programs, including a $5 million client recoverable and growth from vehicle protection. Results were partially offset by declines in credit insurance. Full-year 2017 net operating income increased compared to 2016, driven by higher contributions from Connected Living and vehicle protection. In 2017, Global Lifestyle benefitted from $22.1 million of disclosed items, excluding reportable catastrophes, compared to $18.0 million in 2016.

- Net earned premiums, fees and other income decreased compared to fourth quarter 2016, driven by a previously disclosed change in a program structure for a large service contract client in Global Lifestyle. Excluding this $89 million reduction, fourth quarter 2017 revenue increased 9 percent, primarily due to growth from global mobile and vehicle protection programs. This was partially offset by reduced mobile trade-in activity resulting from lower sales of new smartphones in the latter part of 2017. For full-year 2017, net earned premiums, fees and other income decreased driven by a previously disclosed change in program structure for a large service contract client in Global Lifestyle. Excluding this $503 million reduction, full-year 2017 revenue increased 6 percent, primarily due to global mobile and vehicle protection growth.

- Combined ratio for risk-based businesses(a) increased to 96.3 percent from 95.6 percent in fourth quarter 2016, driven by declines in the credit insurance business, net of a $4.6 million favorable development related to third quarter 2017 reportable catastrophes mainly in the vehicle protection business. For full-year 2017, the combined ratio for risk-based businesses increased to 96.2 percent from 95.9 percent in 2016 reflecting the 2017 reportable catastrophes mentioned above.

- Pre-tax margin for fee-based, capital-light businesses(b) was 5.4 percent, compared to 3.7 percent in fourth quarter 2016. The increase was primarily due to improved results in mobile, reflecting a client recoverable of $7.7 million, growth in covered devices and favorable loss experience. Lower mobile trade-in activity partially offset the increase. For full-year 2017 the pre-tax margin for fee-based, capital-light businesses was 5.7 percent, compared to 3.5 percent in 2016. The margin improvement largely benefitted from $14.4 million in client recoverables for both service contracts and mobile over the course of the year. Absent those recoveries, pre-tax margin increased due to expense savings in service contracts and growth from new mobile programs. Trade-in activity was down year-over-year from lower volumes of new smartphone sales in the latter part of 2017.

(a) Combined ratio for the Global Lifestyle risk-based businesses is equal to total policyholder benefits, losses and expenses, divided by net earned premiums and fees and other income for global vehicle protection, credit and other businesses.

(b) Pre-tax margin for the Global Lifestyle fee-based, capital-light businesses is equal to income before provision for income taxes divided by total net earned premiums, fees and other income for Connected Living, including mobile and extended service contracts.

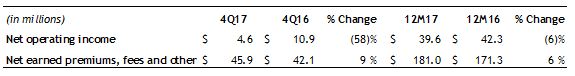

- Net operating income decreased in fourth quarter and full-year 2017 primarily due to a $5.0 million software impairment. Excluding the impairment, underlying business performance remained relatively constant.

- Net earned premiums, fees and other income increased in the fourth quarter and for full-year 2017, primarily driven by growth in Canada and realization of revenue from prior period sales in the U.S. of the Final Need product.

- Face sales for the fourth quarter and full-year 2017 declined due to lower Final Need sales. Fourth quarter 2017 face sales totaled $221.1 million compared to $231.3 million in fourth quarter 2016. Full-year 2017 face sales were $915.9 million compared to $942.6 million for full-year 2016.

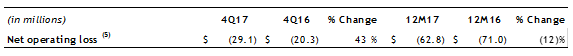

- Net operating loss5 increased in fourth quarter 2017, primarily due to lower net investment income and a $4.6 million charge related to workforce reductions. For the full year, the net operating loss was lower than 2016 reflecting reduced expenses partially from ongoing expense management initiatives.

Capital Position

- Corporate capital was approximately $540 million as of Dec. 31, 2017. Deployable capital totaled approximately $290 million, net of the company’s $250 million risk buffer. Dividends from the businesses paid to the holding company in the fourth quarter totaled $129 million. This included $21 million from Assurant Employee Benefits and Assurant Health. Dividends from the operating segments, Global Housing, Global Lifestyle and Global Preneed totaled $108 million. For full-year 2017, dividends paid to the holding company totaled $374 million. This included $229 million from the Global Housing, Global Lifestyle and Preneed segments, and $145 million from Assurant Employee Benefits and Assurant Health. Dividends from the operating segments, Global Housing, Global Lifestyle and Global Preneed were below total segment earnings for full-year 2017 to support the $95 million reduction in statutory surplus, resulting from the enactment of tax reform.

- Share repurchases and dividends totaled $169 million in fourth quarter 2017. Dividends to shareholders totaled $30 million, and Assurant repurchased approximately 1.4 million shares of common stock for $139 million. Currently, there is $293.4 million remaining under the current repurchase authorization. For full-year 2017, share repurchases and dividends totaled $510 million. Assurant repurchased approximately 3.9 million shares of common stock overall for $389 million and paid dividends to shareholders totaling $119 million.

Company Outlook

On October 18, 2017, Assurant announced an agreement to acquire The Warranty Group from TPG Capital for $2.5 billion of enterprise value, including The Warranty Group’s existing debt. The acquisition is expected to close in the second quarter of 2018. The impact of the acquisition and the related financing plan are not included in the 2018 outlook.

Based on current market conditions, for full-year 2018 the company expects:

- Assurant net operating income, excluding reportable catastrophe losses, to increase between 10 to 14 percent from 2017 reported results of $412 million. Earnings growth to reflect a lower effective tax rate, and modest growth in underlying segment earnings when adjusting for $12.5 million of net benefits in 2017 disclosed items. Profitable growth in Connected Living and multifamily housing, as well as vehicle protection to offset declines in lender-placed insurance and credit insurance. With the enactment of the U.S. Tax Cuts and Jobs Act (TCJA), Assurant’s consolidated effective tax rate is expected to decrease to 22-23 percent from 33 percent, with approximately one-third of the savings to be reinvested to support future growth.

- Assurant operating earnings per diluted share, excluding catastrophe losses to grow in excess of net operating income, reflecting the benefit of a lower consolidated effective tax rate, modest growth in underlying earnings, as well as capital management.

- Global Housing net operating income, excluding reportable catastrophes, to be down before taking into account recently enacted tax reform. Further declines in lender-placed insurance expected as the housing market continues to improve. Declines to be partially offset by continued growth in multifamily housing and improved performance in mortgage solutions. Additional savings from expense management efforts to be realized towards the end of 2018 and into 2019. Net operating income to increase after reflecting a lower effective tax rate of approximately 20 percent, with a portion of the tax savings to be reinvested for future growth. Revenue expected to approximate 2017 levels as declines in lender-placed are offset by growth in multifamily housing and mortgage solutions.

- Global Lifestyle net operating income to increase, before taking into account recently enacted tax reform. Profitable growth driven primarily by newly launched mobile programs and vehicle protection offerings and ongoing expense management efforts, partially offset by ongoing declines in credit insurance. Mobile trade-in activity to vary based on the timing and availability of new smartphone introductions and carrier promotional activity. Results to benefit from a lower effective tax rate of approximately 22 percent, with a portion of the tax savings to be reinvested for future growth. Revenue expected to increase from growth in Connected Living and vehicle protection, globally.

- Global Preneed revenue and earnings to continue to increase modestly from our alignment with market leaders, before taking into account recently enacted tax reform. Results to benefit from a lower effective tax rate of roughly 22 percent, with a portion of the tax savings to be reinvested for future growth.

- Corporate & Other6 full-year net operating loss to approximate 2017 loss of $63 million, before taking into account recently enacted tax reform. Increased investments for growth will be partially funded by continued expense management initiatives. The loss will increase after accounting for an effective tax rate of approximately 20 percent.

- Business segment dividends from Global Housing, Global Lifestyle and Global Preneed to be at least equal to segment net operating income including catastrophe losses, subject to the growth of the businesses, the impact of TCJA, and rating agency and regulatory capital requirements. Capital to be deployed primarily to fund investments in the business, common stock dividends and share repurchases, subject to market conditions, The Warranty Group acquisition financing plan and other factors.

Earnings Conference Call The fourth quarter 2017 earnings conference call and webcast will be held Friday, Feb. 9, 2018 at 8:30 a.m. ET. The live and archived webcast, along with supplemental information, will be available on Assurant’s Investor Relations website http://ir.assurant.com/investor/default.aspx.

About Assurant

Assurant, Inc. (NYSE: AIZ) is a global provider of risk management solutions, protecting where consumers live and the goods they buy. A Fortune 500 company, Assurant focuses on the housing and lifestyle markets, and is among the market leaders in mobile device protection and related services; extended service contracts; vehicle protection; pre-funded funeral insurance; renters insurance; lender-placed homeowners insurance; and mortgage valuation and field services. With approximately $32 billion in assets as of December 31, 2017 and $6 billion in 2017 revenue, Assurant operates in 16 countries, while its Assurant Foundation works to support and improve communities. Learn more at Assurant.com or on Twitter @AssurantNews.

Media Contact: Linda Recupero Senior Vice President, Global Communication Phone: 212.859.7005 [email protected]

Investor Relations Contacts: Suzanne Shepherd Vice President, Investor Relations Phone: 212.859.7062 [email protected]

Sean Moshier Manager, Investor Relations 212.859.5831 [email protected]

Safe Harbor Statement Some of the statements included in this news release and its exhibits, particularly those anticipating future financial performance, business prospects, growth and operating strategies and similar matters including with respect to the pending transaction with The Warranty Group and the benefits and synergies of the transaction, are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these statements by the use of words such as “outlook,” “will,” “may,” “can,” “anticipates,” “expects,” “estimates,” “projects,” “intends,” “plans,” “believes,” “targets,” “forecasts,” “potential,” “approximately,” or the negative version of those words and other words and terms with a similar meaning. Any forward-looking statements contained in this news release or its exhibits are based upon our historical performance and on current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. Our actual results might differ materially from those projected in the forward-looking statements. The company undertakes no obligation to update or review any forward-looking statements in this news release or the exhibits, whether as a result of new information, future events or other developments. The following risk factors could cause our actual results to differ materially from those currently estimated by management, including those projected in the company outlook:

| (i) | the successful completion of the pending transaction with The Warranty Group and the effective integration of its operations; |

| (ii) | the loss of significant client relationships or business, distribution sources and contracts; |

| (iii) | the impact of general economic, financial market and political conditions; |

| (iv) | the adequacy of reserves established for future claims; |

| (v) | the impact of catastrophic losses, including human-made catastrophic losses; |

| (vi) | a decline in our credit or financial strength ratings; |

| (vii) | risks related to our international operations, including fluctuations in exchange rates; |

| (viii) | an impairment of the Company’s goodwill or other intangible assets resulting from a sustained significant decline in the Company’s stock price, a decline in actual or expected future cash flows or income, a significant adverse change in the business climate or slower growth rate, among other circumstances; |

| (ix) | a failure to effectively maintain and modernize our information technology systems; |

| (x) | the Company’s vulnerability to system security threats, data protection breaches, cyber-attacks and data breaches compromising client information and privacy; |

| (xi) | significant competitive pressures in our businesses or changes in customer preferences; |

| (xii) | the failure to find and integrate suitable acquisitions and new ventures; |

| (xiii) | a decline in the sales of our products and services resulting from an inability to develop and maintain distribution sources or attract and retain sales representatives; |

| (xiv) | a decrease in the value of our investment portfolio; |

| (xv) | the impact of recently enacted tax reform legislation in the U.S.; |

| (xvi) | the impact of unfavorable outcomes in potential litigation and/or potential regulatory investigations; |

| (xvii) | the extensive regulations we are subject to could increase our costs; restrict the conduct of our business and limit our growth; |

| (xviii) | the failure to successfully manage outsourcing activities, such as functions in our mortgage solution business and call center services; |

| (xix) | a decline in the value of mobile devices in our inventory or those that are subject to guaranteed buyback provisions; |

| (xx) | the unavailability or inadequacy of reinsurance coverage; |

| (xxi) | the insolvency of third parties to whom we have sold or may sell businesses through reinsurance or modified co-insurance; |

| (xxii) | the credit risk of some of our agents that we are exposed to due to the structure of our commission program; |

| (xxiii) | the inability of our subsidiaries to pay sufficient dividends to the holding company; and |

| (xxiv) | the failure to attract and retain key personnel and to provide for succession of senior management and key executives. |

For a detailed discussion of the risk factors that could affect our actual results, please refer to the risk factors identified in our SEC reports, including, but not limited to our Annual Report on Form 10-K, as filed with the SEC.

Non-GAAP Financial Measures

- Assurant uses net operating income (as defined below), excluding reportable catastrophes, as an important measure of the company’s operating performance. The company believes net operating income, excluding reportable catastrophes, provides investors a valuable measure of the performance of the company’s ongoing business because it excludes the effect of reportable catastrophes, which can be volatile. The comparable GAAP measure is net income.

- Assurant uses net operating income (as defined below) per diluted share, excluding reportable catastrophes, as an important measure of the company's stockholder value. The company believes this metric provides investors a valuable measure of stockholder value because it excludes the effect of reportable catastrophes, which can be volatile. The comparable GAAP measure is net income per diluted share, defined as net income divided by weighted average diluted shares outstanding.

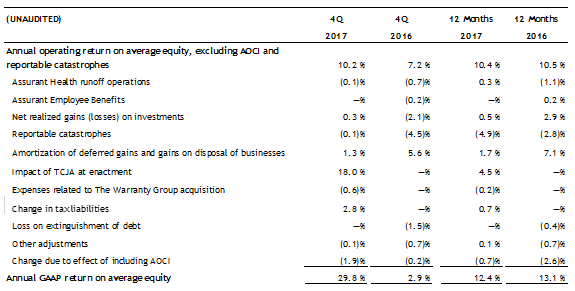

- Assurant uses operating return on equity ("Operating ROE"), excluding accumulated other comprehensive income ("AOCI") and reportable catastrophes, as an important measure of the company’s operating performance. Operating ROE, excluding AOCI and reportable catastrophe losses, equals net operating income (as defined below) for the periods presented divided by average stockholders’ equity, excluding AOCI and reportable catastrophes, for the year-to-date period. The company believes Operating ROE excluding AOCI and reportable catastrophe losses provides investors a valuable measure of the performance of the company’s ongoing business, because it excludes the effect of Assurant Health runoff operations, the divested Assurant Employee Benefits business, which was sold on March 1, 2016, and reportable catastrophes, which can be volatile. The calculation also excludes net realized gains (losses) on investments, amortization of deferred gains and gains on disposal of businesses and those events that are highly variable and do not represent the ongoing operations of the company. The comparable GAAP measure is GAAP return on equity (“GAAP ROE”), defined as net income, for the period presented, divided by average stockholders’ equity for the year.

- Assurant uses net operating income as an important measure of the company’s operating performance. Net operating income equals net income excluding Assurant Health runoff operations, Assurant Employee Benefits, net realized gains (losses) on investments, amortization of deferred gains and gains on disposal of businesses and other highly variable items. The company believes net operating income provides a valuable measure of the performance of the company’s ongoing business because it excludes the effect of Assurant Health runoff operations and the divested Assurant Employee Benefits business, which the company sold on March 1, 2016. The calculation also excludes net realized gains (losses) on investments, amortization of deferred gains and gains on disposal of businesses and those events that are highly variable and do not represent the ongoing operations of the company. The comparable GAAP measure is net income.

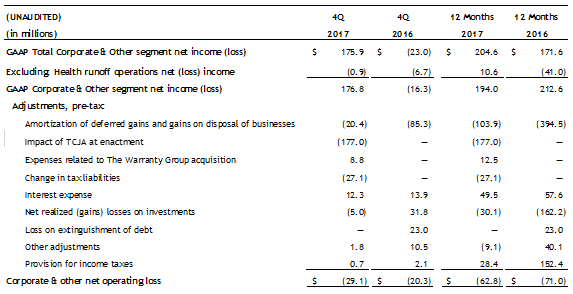

- Assurant uses Corporate & Other net operating loss as an important measure of the corporate segment’s operating performance. Corporate & Other net operating loss equals Total Corporate & Other segment net income, excluding Assurant Health runoff operations net income (loss), amortization of deferred gains and gains on disposal of businesses, net realized gains (losses) on investments, interest expense and other highly variable items. The company believes Corporate & Other net operating loss provides a valuable measure of the performance of the company’s corporate segment because it excludes the effect of amortization of deferred gains and gains on disposal of businesses, net realized gains (losses) on investments, interest expense and those events that are highly variable and do not represent the ongoing operations of the company’s corporate segment. The comparable GAAP measure is Total Corporate & Other segment net income.

- The company outlook for Corporate & Other full-year net operating loss constitutes forward-looking information and the company believes that it cannot reconcile such forward-looking information to the most comparable GAAP measure without unreasonable efforts. A reconciliation would require the company to quantify amortization of deferred gains and gains on disposal of businesses, interest expense, net realized gains on investments, and change in derivative investment. The last two components cannot be reliably quantified due to the combination of variability and volatility of such components and may, depending on the size of the components, have a significant impact on the reconciliation. The company is able to reasonably quantify a range for the first component for the forecast period, based on certain assumptions relating to future reinsured premium on disposed business during the forecast period. In addition, the company is assuming it does not incur additional debt or extinguish debt in the forecast period. Amortization of deferred gains and gains on disposal of businesses is expected to be approximately $42-50 million after-tax while interest expense is expected to be approximately $42-44 million after-tax. This reflects the lower effective tax rate. In addition, the company is assuming it will refinance $350M of debt maturing in March 2018 but will not incur additional debt in the forecast period.

A summary of net operating income disclosed items is included on page 21 of the company’s Financial Supplement, which is available on Assurant’s Investor Relations website http://ir.assurant.com/investor/default.aspx.

Assurant, Inc.

Consolidated Statement of Operations (unaudited)

Three Months and Twelve Months Ended Dec. 31, 2017 and 2016

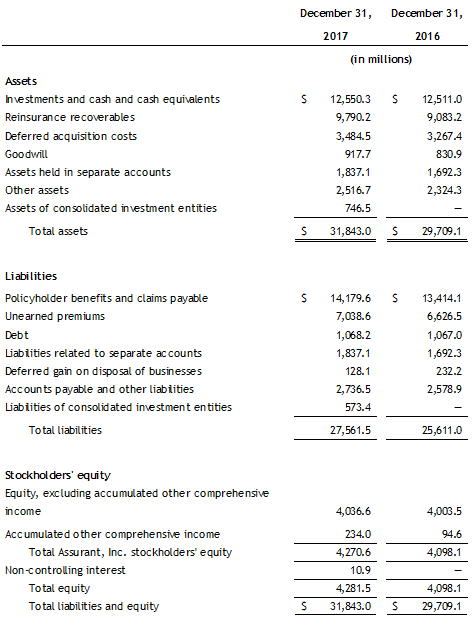

Assurant, Inc.

Consolidated Condensed Balance Sheets (unaudited)

At Dec. 31, 2017 and Dec. 31, 2016